Gross Monthly Income Meaning Philippines

Divide by the months in the year. P76669 to P131484 monthly income.

What S Ideal Monthly Income For Family Of 4

Basic necessities such as food and shelter and education all require considerable amounts of money.

Gross monthly income meaning philippines. Gross monthly income meaning philippines. The resulting number can be multiplied by 52 for the weeks in the year. Philippines gni for was 000B a 100 decline from 2019.

It includes allowances overtime commissions bonus etc. We created this to allow individuals to have an idea on how much their net pay would be. How much is your gross monthly income.

They can do so by multiplying their hourly wage rate by the number of hours worked in a week. Please do not use the app as a replacement. Compute the total annual contributions.

We are continuously working with Certified Public Accountants when making changes to this app. Average Family Income in 2015 is Estimated at 22 Thousand Pesos Monthly Results from the 2015 Family Income and Expenditure Survey The survey results showed that the average annual family income of Filipino families was approximately 267 thousand pesos. Account for the acting role.

Nobody should be living on minimum wage their whole life as this can compromise not only their future but. To determine gross monthly income from hourly wages individuals need to know their yearly pay. Php 30000 x 12 months Php 360000.

Anika works two part-time jobs with different hours and pay rates. Royalties rentals of property real or personal profits from exchange and all other items treated as gross income under Sec. Gross income refers to amount before deduction of CPF.

Upper middle but not rich. 10 x 15. An example would be start of working age at 25 and retirement age of 65.

From your gross salary the salary as reflected on your employment contract subtract your monthly contributions and income tax. Men receive an average salary of 1084811 PHP. The final result can be divided by 12.

5 People in the house 800. Gross income represents the total income from all sources including returns discounts and allowances before deducting any expenses or taxes. The gross monthly average income is based on data supplied by the National Statistics Office to the International Labour Organization 9.

Get the annual salary. Taxable income is the gross income minus any salary deductions and tax exemptions. The average income includes the salaries and wages of paid employees.

What is her gross monthly income. All data are based on 3087 salary surveys. So continuing on our example above that assuming your salary is 25000 per month a total monthly contributions worth 1600 and.

4000 Total of father and mothers monthly income --------------------------------------. The very same farmers who are largely responsible for the gross domestic product live on minimum wage. In comparison the average annual family expenditure for the same year was 215 thousand pesos.

Employees include both men and women unless otherwise noted. Women receive a salary of 703907 PHP. Follow this formula to compute your taxable income.

Get Your Taxable Income. The Philippines is known as a major exporting country in the world. Average salary in Philippines is 856997 PHP per year.

Salaries are different between men and women. Socioeconomic Planning Secretary Karl Chua said the government needs to improve the definitions and the terms to identify social classes in the Philippines after senators noted that the labels used were confusing. The deductions are representative of single.

How many working years until 65. P219140 and above monthly income. P131483 to P219140 monthly income.

Philippines gni for 2017 was 37143B a 378 increase from 2016. 3 The compulsory deductions include social security and income tax t. Employee with a gross monthly salary of Php 30000 and receiving 13th-month pay of the same amount.

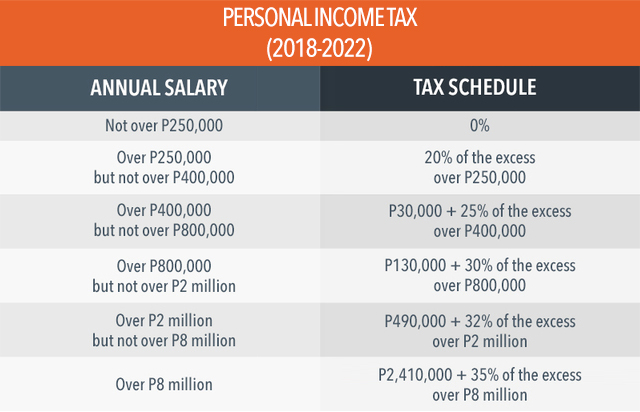

Income tax due Taxable income Gross income Allowable deductions x Tax rate Tax withheld Sample income tax computation for the taxable year 2020. To determine her weekly income from both jobs she works them out individually multiplying her wage by hours worked each week. Of household members living with applicant.

So 65 - 25 40. Philippines Average Salary IncomeThe net average income in constant 2005 US at PPP is computed using the IMF PPP exchange rate d and the US inflation rate d The latter reflects the purchasing power in the United States in 2005 2 The gross monthly average income is based on data supplied by the National Statistics Office to the. Gross income per month Hourly pay x Hours per week x 52 12.

The most typical earning is 335513 PHP. Philippines gni for 2019 was 41575B a 518 increase from 2018. 32 of the Tax Code as amended 7 Net trading gains within the taxable year of foreign currency debt securities derivatives and other similar financial instruments.

Sweldong Pinoy is for personal use. Passive income which have been subject to a final tax at source do not form part of gross income for purposes of computing the MCIT. Gross income means gross sales less sales returns discounts and cost of goods sold.

Taxable Income Monthly Basic Salary Overtime Pay Holiday Pay Night Differential SSS PhilHealth and Pag-IBIG Contributions Tardiness Absences. Philippines gni for 2018 was 39527B a 642 increase from 2017. Multiply by the weeks in a year.

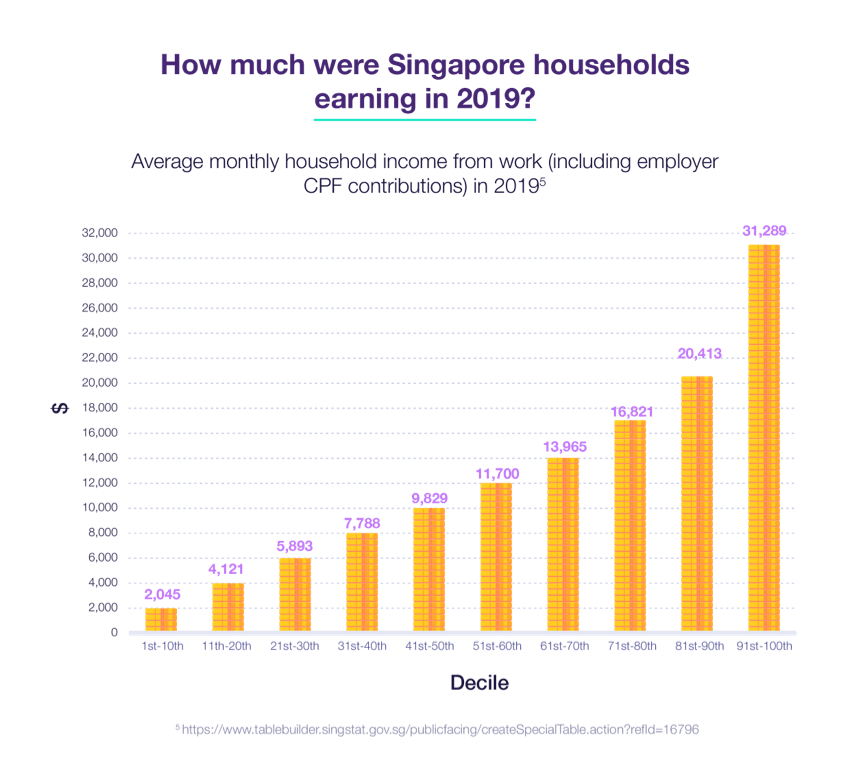

Are You Earning Enough Singapore S Average Household Income Revealed Standard Chartered Singapore

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Average Salary In Japan 2021 The Complete Guide

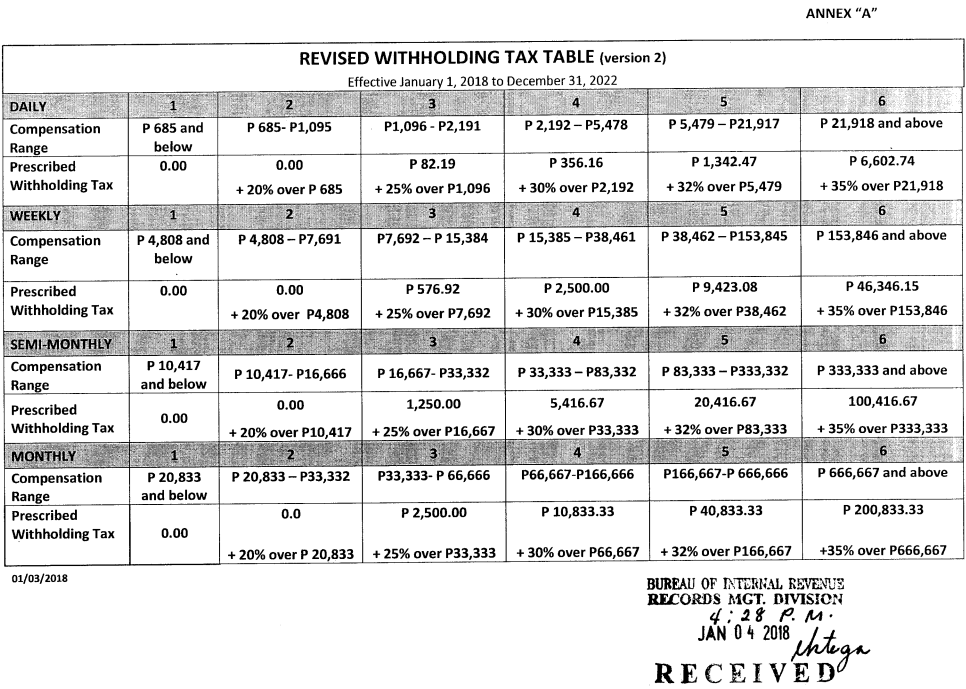

How To Compute Philippine Bir Taxes

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

Learn How To Read A Balance Sheet To Understand Your Business S Financial Position On A Specific Dat Balance Sheet Statement Template Profit And Loss Statement

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

How To Calculate Gross Income Per Month The Motley Fool

Philippine Monthly Average Salary 2020 Statista

Tax Calculator Compute Your New Income Tax

Shop Planner Business Planner Etsy Seller Planner Small Business Etsy Business Business Printable Business Goals Business Planner Small Business Organization Business Planning

Household Monthly Income Per Person Calculator

Gross Income Formula Step By Step Calculations

How To Calculate Gross Income Per Month The Motley Fool

How To Compute Your Income Tax In The Philippines

Annual Income Learn How To Calculate Total Annual Income

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How To Compute Your Income Tax In The Philippines

Post a Comment for "Gross Monthly Income Meaning Philippines"