Job Keeper Salary Sacrifice

When can we expect to receive the first JobKeeper subsidy. It shows as 0 Gross wages Full JobKeeper in allowances instead of Jobkeeper.

Definitiv How Do I Manage Salary Sacrifice Arrangements With Jobkeeper

The best information I could find on salary sacrificing was from the FAQ page at the Department of Treasury website.

Job keeper salary sacrifice. We have provided links for a similar question asked previously. Adam pays Nick his 500 before tax per fortnight salary and an additional 250 per fortnight before tax for the JobKeeper fortnights between 28 September 2020 and 3 January 2021 totalling 750 before tax per fortnight. This taxable gross ignoring the sacrificed amount equates to 700 per fortnight so you would need to process a top up payment of 800 for the fortnight in Sage MicrOpay to meet the ATOs requirements.

As a NFP we have staff that salary sacrifice amounts each pay. I CURRENTLY HAVE A SALARY SACRIFICE ARRANGEMENT WITH MY EMPLOYER. That one person nominated in their director.

The JobKeeper scheme has been extended from 28 September 2020 until 28 March 2021 and contains two separate extension periods. The JobKeeper Payment may be paid to an employee in cash or as a fringe benefit or an extra. Our business is struggling with cash flow.

Assign the amount being. The employer must pay the employee at least 1500 a fortnight to receive the JobKeeper payment. However it is important to note that only one director can be nominated by a business to receive the Job Keeper payment.

Adam receives a JobKeeper payment of 750 per fortnight which will subsidise the cost of Nicks salary. However you can only receive the Job Keeper payment from one employer your primary employer. Prior to 28 September 2020 the JobKeeper Payment was 1500 earnings before tax per fortnight paid to the employer as a supplement to assist with the payment of salary and wages.

Creation of new pay item Optional Technically step 1 is optional however if you wish to track and report the. Processing When processing in a pay run you will need to do the following. Where an employee is paid more than 1500 per fortnight the employers superannuation obligations will not change.

Directors can qualify for the Job Keeper payment if they fit the eligible business participant requirements set out in the Job Keeper scheme. The 1500 payment can be made up of various components including salary wages commission bonuses allowances PAYG withholding superannuation contributions made under a salary sacrifice arrangement and other amounts forming part of salary sacrifice arrangements. As an example if a weekly paid eligible employee is paid an hourly rate plus casual loading of 350 per week with an effective salary sacrifice arrangement of 100 per week.

That legislation I was talking about in this video has now passed and you cannot reduce the compulsory super contribution because of a salary sacrifice. This includes being actively engaged in the business carried on by the entity. Discussion JobKeeper - STP and Salary Sacrifice Super Author Date within 1 day 3 days 1 week 2 weeks 1 month 2 months 6 months 1 year of Examples.

Ashfords Accountants Advisory - JobKeeper Payment. A business will use the subsidy to recoup some of their salary and wage expense paid to the employee. If you wish to Salary Sacrifice all or part of your JobKeeper Payment you will need to ensure that all of this amount is entered as Ordinary Earnings or BonusCommission before you add it to Salary Sacrifice.

As long as you have paid your eligible employees at least 1500 before tax per fortnight to. It does not matter whether the employee received more than 1500 a fortnight previously. I have a staff member who is only on jobkeeper set up as allowance but when I put through her sal sacrifice it doesnt show up on the STP reports correctly.

Superannuation salary sacrifice aka Additional employer super This tutorial demonstrates how to process additional employer superannuation in Free Accounting Software. PAYGW AND SUPERANNUATION ON THE JOBKEEPER PAYMENT You must pay a minimum of 1500 per fortnight to your eligible employees withholding income tax as appropriate. We suggest that you liaise with your STP software provider to confirm that you are entering the pay information correctly.

The JobKeeper payments wage subsidy scheme was introduced to ensure businesses struggling due to the health and economic challenges created by the COVID-19 pandemic are better equipped to retain employees if still operating or to stay connected to employees if their business has closed. JobKeeper is a reimbursement to you so any amounts you pay to your employee that are salary sacrificed can be reimbursed. The 1500 per fortnight per employee is a before tax amount.

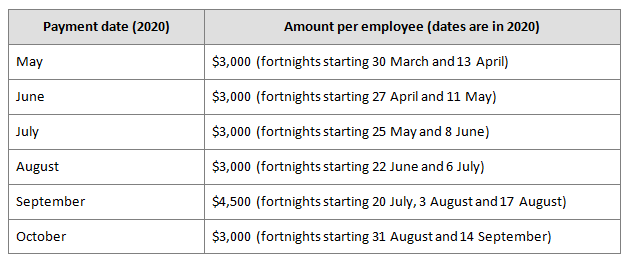

The JobKeeper Payment can be used to subsidise payments such as salary or wages annual leave and salary sacrificed super but not super guarantee. Eligible employers will be able to claim a fortnightly payment of 1500 per eligible employee from 30 March 2020 for a maximum period of 6 months. Your understanding is correct.

Amounts applied under an effective salary sacrifice arrangement can count towards the JobKeeper payment with regard to satisfying the wage condition. The Government anticipates that around 6 million workers will benefit from the JobKeeper payment or around half of the Australian workforce. It will not Salary Sacrifice correctly if it is in the JobKeeper Top-Up section.

How do I manage salary sacrifice arrangements with JobKeeper. The Job Keeper Payment is not income-tested so you may earn additional income without your payment being affected as long as you are eligible and maintain your employment including being stood down with your Job Keeper-eligible employer.

Congratulation For Job Achievement Congrats Quotes Congratulations For Job Congratulations Quotes Achievement

Guide Processing Monthly Jobkeeper Payments Employment Hero Helpcentre Au

Xero Is Ready To Process Your Jobkeeper Top Up Payments Now Benkorp

Definitiv How Do I Manage Salary Sacrifice Arrangements With Jobkeeper

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

Managing The Jobkeeper Payment Payroll Support Au

Jobkeeper Payment The Devil Is In The Detail Hall Wilcox

Xero Is Ready To Process Your Jobkeeper Top Up Payments Now Benkorp

Europe Work Permit Poland Azerbaijan Jobs In Store Keeper And Construction Indian Salary 50 000 To 80 Permit Poland Work Permit

Managing The Jobkeeper Payment Payroll Support Au

Jobkeeper Payments For Accountedge Support Notes Myob Accountedge Myob Help Centre

The Jobkeeper Payment Explained Everything You Need To Know Taxbanter

Jobkeeper March To September 2020 Payroller Guide Manual

Jobkeeper Payment Subsidy Ascender Hcm Pty Ltd

Covid 19 Australia Employer Guide To Jobkeeper Payments Second Edition Lexology

Employee Eligibility For Jobkeeper Payments What To Do Next Jobkeeper Legislation Update Benkorp

Definitiv How Do I Manage Salary Sacrifice Arrangements With Jobkeeper

Frequently Asked Questions About Jobkeeper

Unpacking The Jobkeeper Payment Rules Cooper Partners

Post a Comment for "Job Keeper Salary Sacrifice"