Salary Sacrifice Pension Uk

Salary sacrifice is a tax-efficient way for you to make pension contributions. Salary sacrifice is a more tax-efficient way for you to make pension contributions.

Salary Sacrifice Pension Scheme

If the amount of your salary you choose to sacrifice brings you below a certain threshold you may lose a proportion of life cover your employer provides.

Salary sacrifice pension uk. What is a salary sacrifice pension. If youre part of a workplace pension you and your employer will contribute every month. A lower income could mean reduced benefits from your employer.

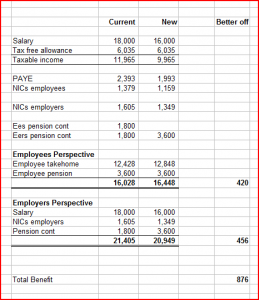

It allows you to give up some of your gross salary in exchange for a non-cash benefit such as an employer contribution. Not only would the business save money but the pension scheme members could also see an increase in their take home pay or benefit from higher pension contributions. Find out more about tax relief.

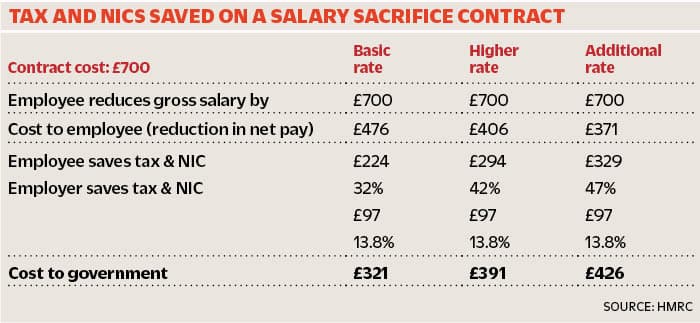

Salary sacrifice lets you make contributions to your pension and helps to save on National Insurance at the same time. This has been updated for the current tax year of 202122. The standard amount of tax relief is a 25 tax top up for basic rate taxpayers meaning that if you put.

Salary sacrifice pension tax relief. A salary sacrifice scheme is a facility that many employers pension schemes can accommodate where instead of receiving your full salary your employer gives you a non-cash benefit towards your pension instead. There are two ways in which you can do this simple salary sacrifice and SMART Save more and reduce tax.

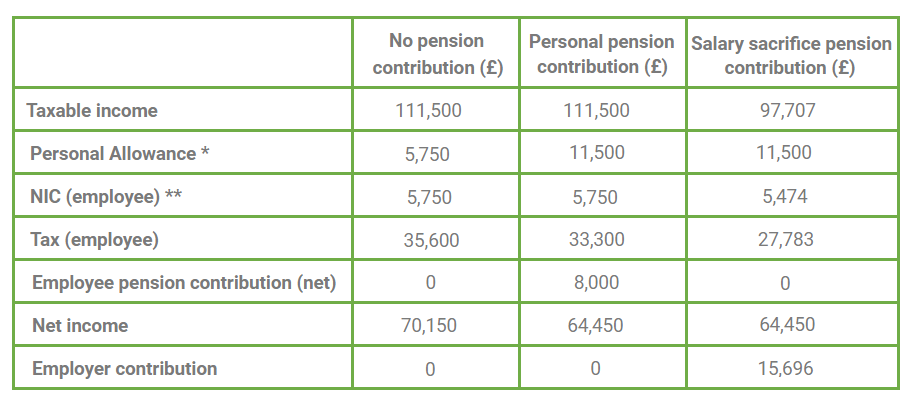

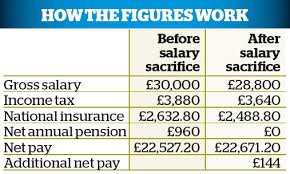

If you sacrifice some of your salary to make payments into your pension then you are also lowering your income. Find out how you might be able to benefit. The minimum your employer must contribute is 3 in the UK though they can choose to contribute more.

Salary sacrifice means you can exchange part of your salary in return for a non-cash benefit from your employer. One way to increase these contributions is via a salary sacrifice scheme. It is simple to follow and shows how you can benefit from doing this.

A business in the UK with 200 employees on average earnings of 30420 could save around 40000 every year by using salary sacrifice for their workplace pension. A salary sacrifice pension scheme is an arrangement between you and your employer in which you agree to give up a certain amount of your salary in exchange for certain non-cash benefits. See how your workplace pension payments add up with our salary sacrifice pension calculator.

When youre enrolled into their pension scheme your employer must. With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. October 15 2019 Tony Stevens Salary Sacrifice Pension Salary sacrifice it may sound more onerous than it is.

You give up some of your wages in exchange for extra contributions into your pension or other employer benefits. You can calculate results based on either a fixed cash value or a certain proportion of your salary. What are the downsides of salary sacrifice.

You can use salary sacrifice to increase contributions to your personal pension. It means that contributions from your employer increase except that they are really. These can include a range of in kind benefits such as childcare vouchers bikes ultra-low emissions vehicles or periods of annual leave but in this case they take the form of payments into your pension.

Salary sacrifice pension tax relief Usually the personal contributions you make to your pension are eligible for tax relief from the government. If for example the non-cash benefit is a pension contribution your employer would pay this along with a contribution they might make directly into your pension pot. Once you accept a salary sacrifice your immediate pay is lower and while this is a short-term sacrifice it can have multiple knock-on effect benefits.

Salary sacrifice schemes allow employees to agree to reduce their earnings by an amount equal to their pension contributions and in exchange the employer then agrees to pay the total pension contributions. Whats in this guide A way to save. Learn more at Scottish Widows.

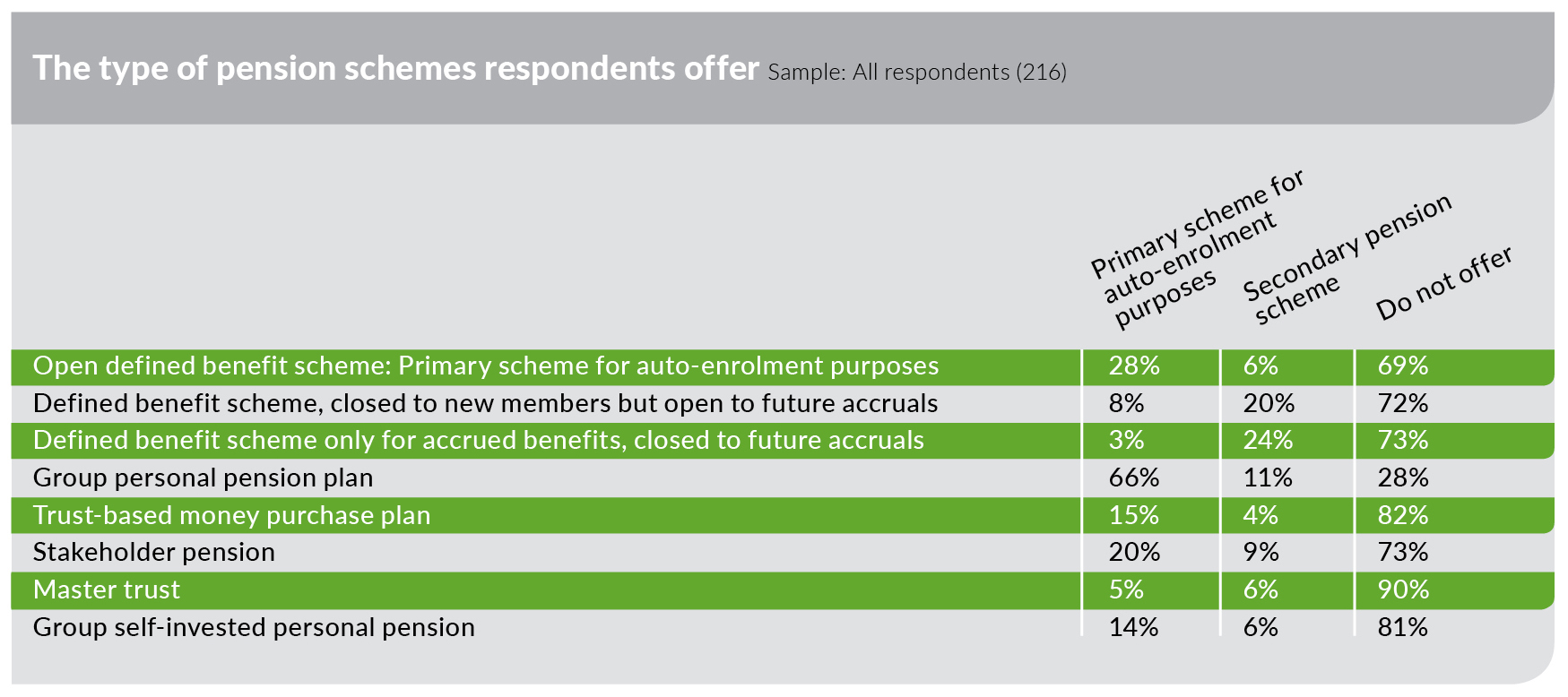

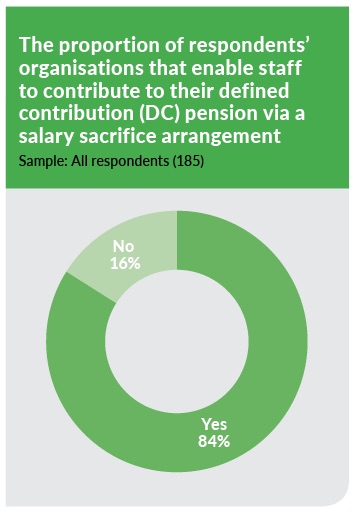

Salary sacrifice is commonly used to boost your pension but you can also give up salary in return for benefits such as. Salary sacrifice enables you to exchange part of your salary for a non-cash benefit from your employer such as increased pension contributions. According to the research 78 of respondents said that their workplace pensions include salary sacrifice schemes with another 9.

This means tax relief cannot be claimed because the employee has been taxed on a lower amount of salary. Pay at least the minimum contributions to the pension scheme on time - usually by. A salary sacrifice scheme sometimes known as a salary exchange can actually be a very tax-efficient way to contribute to your retirement or to reduce your tax bill but it can also have implications for your pension.

Exclusive 84 Offer Salary Sacrifice Pension Arrangements Employee Benefits

Salary Sacrifice And Auto Enrolment Edwards

Salary Sacrifice Benefits To Change In Accountancy

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

Salary Sacrifice Pension Scheme How It Works Benefits

Salary Sacrifice Savvy Financial Planning

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

What Is Pension Salary Sacrifice And Why S It Under Threat Accountingweb

How To Read Your Payslip Pension Deductions Royal London

It May Be Time To Review Your Salary Sacrifice Arrangements Jackson Toms

Https Quantumadvisory Co Uk Wp Content Uploads 2017 07 Salary Sacrifice Flyer A5 Final Pdf

What Is Pension Salary Sacrifice And Why S It Under Threat Accountingweb

How Salary Sacrifice Works Youtube

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Why Use Salary Or Bonus Sacrifice For Pension Funding Savvy Financial Planning

Exclusive 74 Offer Salary Sacrifice Pension Arrangements Employee Benefits

Exclusive 84 Offer Salary Sacrifice Pension Arrangements Employee Benefits

Furloughing Staff Further Information And Examples Of How The Reclaim Is Calculated The Curtis Partnershipthe Curtis Partnership Chartered Certified Accountants In Cheadle Staffordshire

Post a Comment for "Salary Sacrifice Pension Uk"