Gross Monthly Income Calculator Ontario

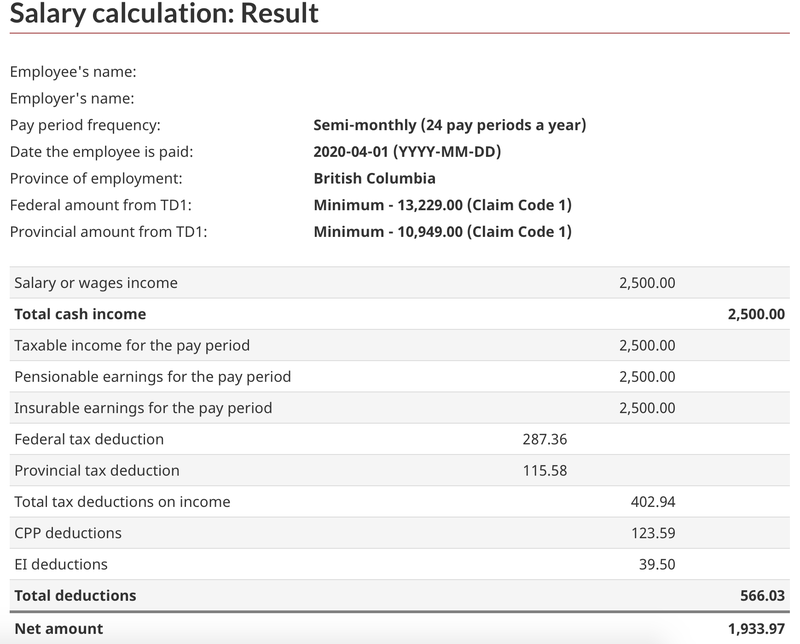

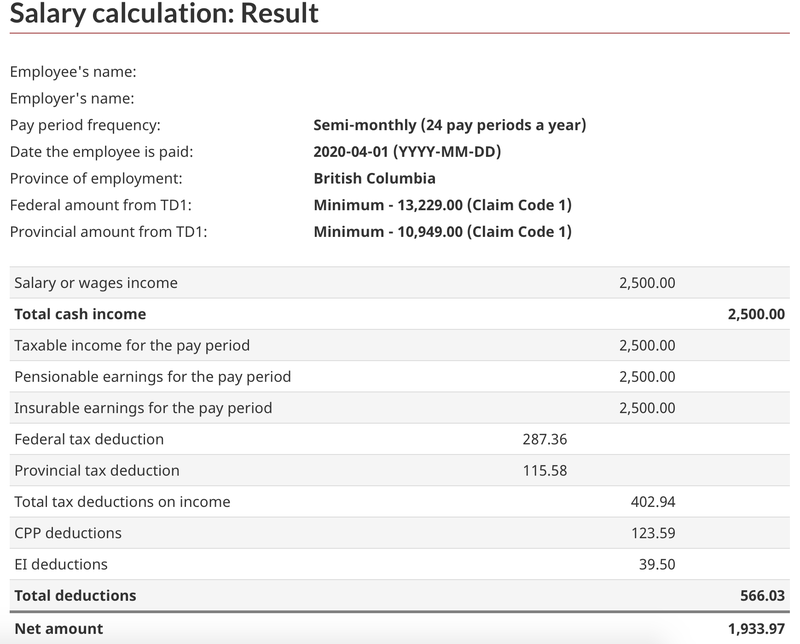

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

How To Create An Income Tax Calculator In Excel Youtube

Monthly Gross Income Calculator Mortgage Payoff Calculator Calculate The Monthly A Mortgage Refinance Calculator.

Gross monthly income calculator ontario. Net annual salary Weeks of work year Net weekly income. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. GDS is the percentage of your monthly household income that covers your housing costs.

Take one of the two calculated amounts from the boxes on the right. The Canada Monthly Tax Calculator is updated for the 202122 tax year. Hourly Pay Rate.

Ontario increases their provincial income thresholds and the basic personal amount through changes in the consumer price index CPI. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month.

Gross monthly income calculator ontario. Canadian Payroll Calculator by PaymentEvolution. The Advanced Tax Calculator is designed for those who wish to calculate their tax commitments with more detail for example you may with you calculate your monthlyquarterlyannual tax withholdings to ensure you retain sufficient revenue to cover the.

Monthly gross pay without commas average weekly hours. What is changing is the level of income in the first two tax brackets. Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income.

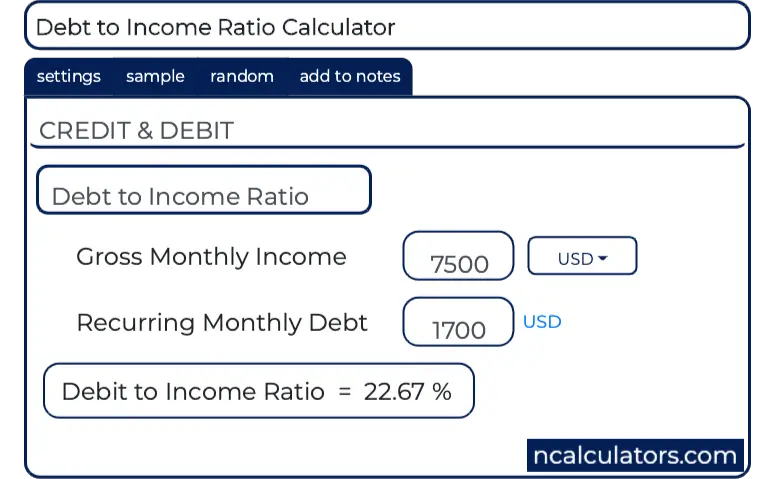

TDS is the percentage of your monthly household income that covers your housing costs and any other debts. This is called the indexing factor. So to calculate if you have the required income for a mortgage the lender takes your projected monthly mortgage payment adds to it your minimum monthly payments for credit cards and any other loans plus legal obligations like child support or alimony and compares it to your monthly income.

The category of fishing and hunting guides is not considered in this calculator as it is very specific. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. The reliability of the calculations produced depends on the accuracy of the information you provide.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. You assume the risks associated with using this calculator. It will confirm the deductions you include on your official statement of earnings.

Gross Monthly Income Calculator. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

It must not exceed 35. Distinguish this with how much tax you have actually paid as expressed on your. 7 lignes Easy income tax calculator for an accurate Ontario tax return estimate.

Formula for calculating net salary. Calculate the gross amount of pay based on hours worked and rate of pay including overtime. Money online Tutorial March 11 2021 February 20 2021.

You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period. Ontarios indexing factor for 2021 is 09. Net annual salary Weeks of work.

For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour. This calculator will give you both. Net salary 57 829 2 100 2 300 net salary 57 829 4 400.

For using the calculator you have to select the Worker type then enter the Hours of work week and Weeks of work year then enter your gross annual income this figure will be on your income statement or latest pay slip and click Calculate. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review.

It must not exceed 42. This marginal tax rate means that your immediate additional income will be taxed at this rate. The amount of taxable income that applies to the.

Gross monthly wage refers to your monthly paycheck before taxes and other deductions. That means that your net pay will be 40512 per year or 3376 per month. Now you can go back to the Dues or Strike Calculator you were working on and enter the appropriate calculated amount into the Pay box on the left side.

Ontario income tax rates will be staying the same in 2021. The Tax figure is the tax you have to pay depending on your salary. Gross annual income Taxes Surtax CPP EI Net annual salary.

Your average tax rate is 221 and your marginal tax rate is 349. If your debt payments are less than 36 percent of your pretax income youre in good shape. Summary report for total hours and total pay.

Paycheck Calculator Take Home Pay Calculator

Debt To Income Ratio Calculator

Home Affordability Calculator For Excel

How To Calculate Gross Income Per Month The Motley Fool

Income Tax Formula Excel University

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Avanti Gross Salary Calculator

Income Tax Formula Excel University

How To Calculate Payroll Tax Deductions Monster Ca

Comprehensive Income Tax Calculator Solid Tax

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Mathematics For Work And Everyday Life

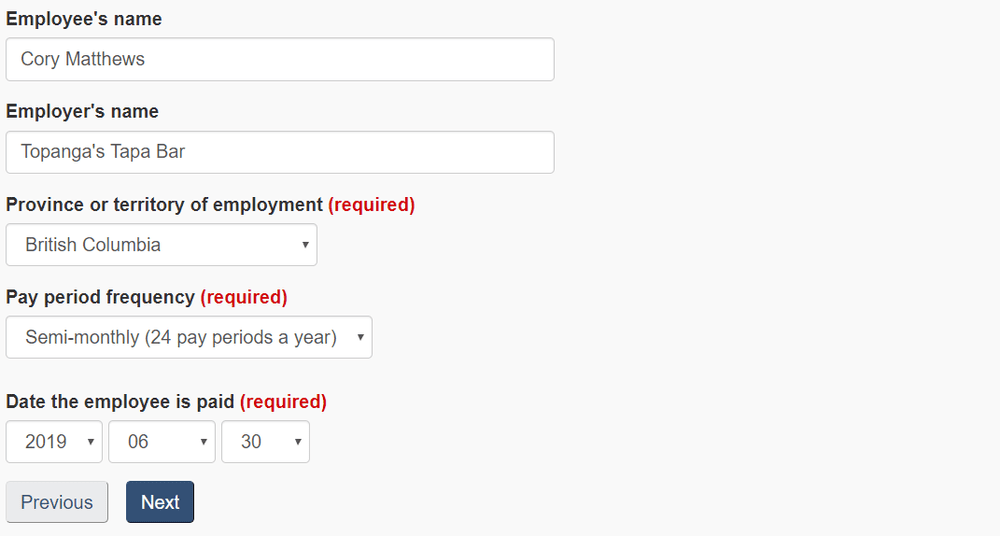

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Tips For Parents Earning A Minimum Wage Salary Going Back To School Canadian Budget Binder

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Income Tax Formula Excel University

Paycheck Calculator Take Home Pay Calculator

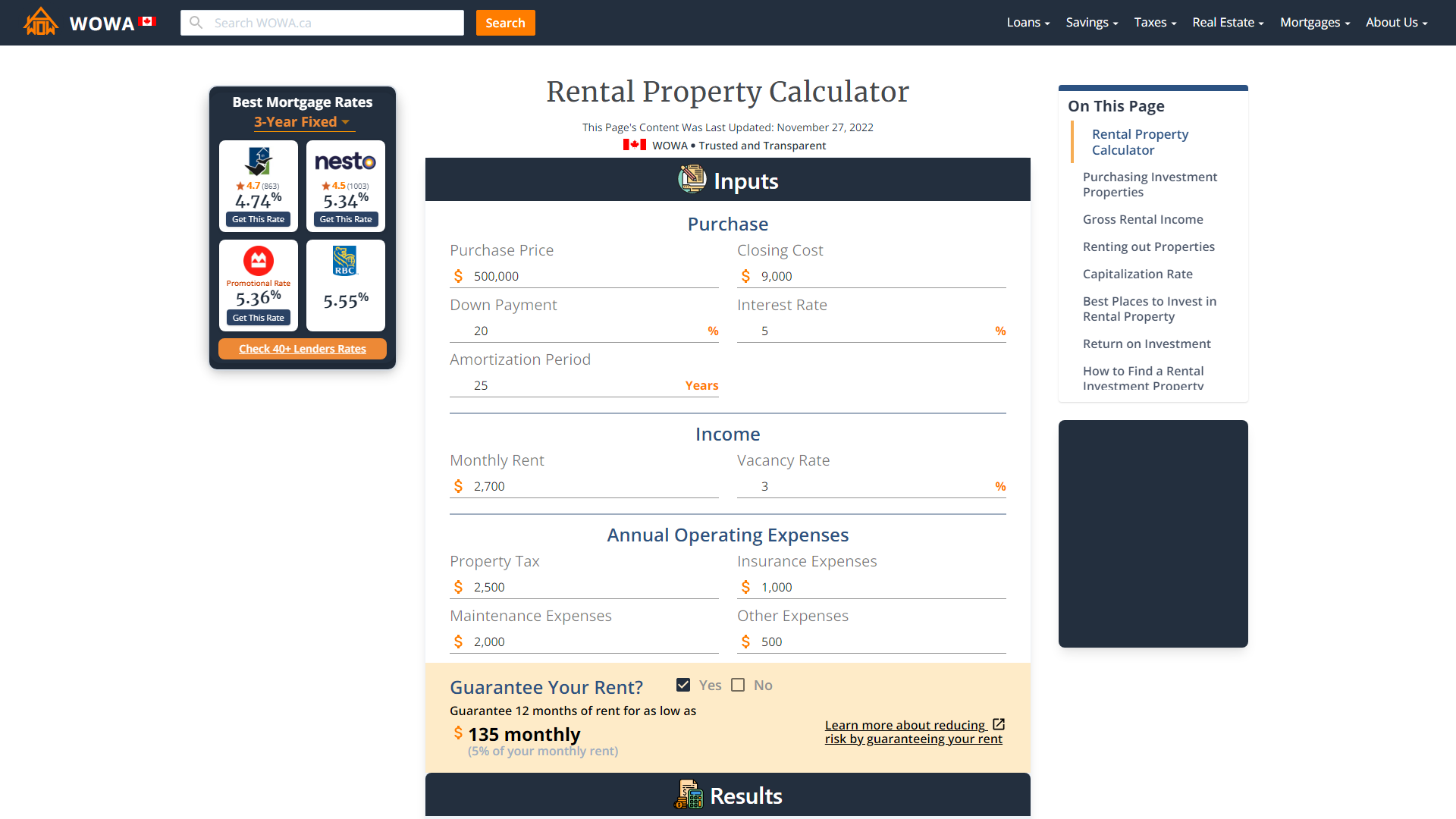

Rental Property Calculator 2021 Wowa Ca

Post a Comment for "Gross Monthly Income Calculator Ontario"