Net Salary Calculator Spain

At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of 43000 without bonuses. The results of the estimation may be affected by changes to the current tax labor or social security.

Payroll In Spain Elements How To Calculate Yours And More

Up to EUR 150.

Net salary calculator spain. Income Tax calculations and expense factoring for 2021 2022 with historical pay figures on average earnings in Spain for each market sector and location. 19 Taxable income EUR 6000 to EUR 50000. All you have to do is enter your pre-tax salary either yearly or monthly and click the calculate button.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of 55000 without bonuses. I recommend you use this tool to estimate your take home salary by CincoDias one of the major newspapers in Spain.

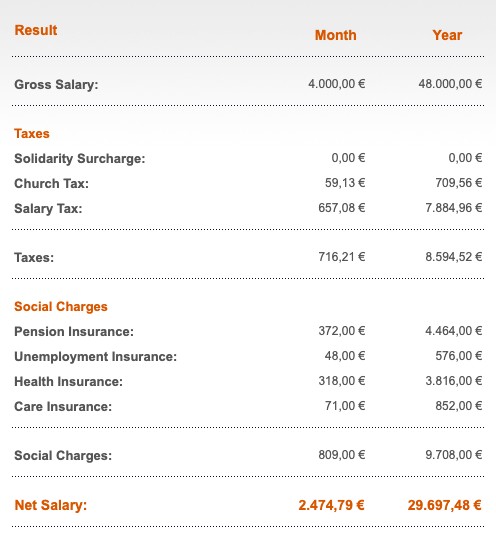

The latest budget information from April 2021 is used to show you exactly what you need to know. Net Salary calculator for Portugal. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany.

Net Monthly Salary 244179. Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. Net Weekly Salary 61045.

This tool should only be used as a guide to what deductions to expect. Youll then get a breakdown of your total tax liability and take-home pay. Calculate your Gross Net Wage - German Wage Tax Calculator.

In Spain an income of 2493601 EUR 2493601 EUR is more than the lowest average advertised salary of 1260000 EUR 1260000 EUR and more than the countrys average income of 2493600 EUR 2493600 EUR. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income. 30 Total deduction 66750 Total net tax liability.

This will give you a first good estimate. This estimation is only for informative purposes and under no circumstances may it be considered binding. Even though we try to make sure that all the values used in the calculation are up to date we cannot.

Net Monthly Salary 235756. Enter your annual salary in the Sueldo Bruto anual cell click on calcular at the botton of the page. Hourly rates weekly pay and bonuses are also catered for.

Net savings taxable base. The results of the calculation are based on the details you have entered. Why not find your dream salary too.

Net Annual Salary 2829070. Net Salary calculator for Spain. You can include your income Capital Gains Overseas Pensions Donations to charity and allowances for family members.

Gross Annual Salary Generally your salary in Belgium is your monthly salary paid out 1392 times per year. Net Weekly Salary 58939. You can work out your annual salary and take home pay using the Spanish Tax Calculator or look at typical earning by entering a figure in the quick calculator or viewing one of the salary examples further down this page.

Total gross tax liability. A minimum base salary for Software Developers DevOps QA and other tech professionals in Spain starts at 19000 per year. Salary after tax calculator for Spain This is probably the simplest calculator to use on this list for calculating your Spain tax rate and net income after paying your IRPF personal income tax or Impuesto sobre renta de personas físicas.

Why not compare the taxation and. Also known as Gross Income. Enter your monthly or annual gross salary and the rest is done automatically.

The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the 2021 Tax Assessment year 1 st January 2021 - 31 st December 2021. Net Annual Salary 2930148. The calculator covers the new tax rates 2021.

This tool lets you calculate how much tax and social insurance contributions are deducted from your salary when working in Cyprus. Salary Before Tax your total earnings before any taxes have been deducted. Salary Gross salary salary non-wage compensation net salary contributions to social security and IRPF deduction Bear in mind that this difference between gross and net salary can be.

The salary calculator estimates your net monthly salary based on financial personal and employment information you provide. Taxable income EUR 0 to EUR 6000. The Spanish Income Tax Salary Calculator is updated for the 2021 2022 tax year.

Therefore to get your gross annual salary multiply your monthly salary by 1392. A minimum base salary for Software Developers DevOps QA and other tech professionals in Portugal starts at 15000 per year. 21 Gross savings tax liability.

Payslip In Spain How Does It Work Blog Parakar

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

Payslip In Germany How Does It Work Blog Parakar

Base Salary Explained A Guide To Understand Your Pay Packet N26

Net And Gross Salary Calculator Calculate Your Salary And Withholdings Bbva

Net And Gross Salary Calculator Calculate Your Salary And Withholdings Bbva

Net Salary Calculator For Personal Taxes Taxscouts

German Payslip Explained How To Read Your Payslip In Germany

How To Calculate Your Net Salary Using Excel Salary Ads Formula

Net And Gross Salary Calculator Calculate Your Salary And Withholdings Bbva

Payroll In Spain Elements How To Calculate Yours And More

Information Technology Average Salaries In Spain 2021 The Complete Guide

How Do You Calculate Salary And Contributions In Hungary Employment In Hungary Helpers

Payslip In Spain How Does It Work Blog Parakar

How Much Does An Employee Cost In Spain Includes Calculator Edco Business Consulting

Payslip In Spain How Does It Work Blog Parakar

Eu Salary Calculator Eu Training

Average Salary In Spain 2021 The Complete Guide

Post a Comment for "Net Salary Calculator Spain"