Net Salary Calculator Uk Married

Your activity intellectual or manual your tax category single married with or without children your advantages. You can calculate your salary on a daily weekly or monthly basis.

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Daycare Costs Child Support

0 An individuals personal allowance is reduced where their income is above this limit.

Net salary calculator uk married. If you would like to have your own wage calculator. Calculate your take home pay in the Netherlands thats your salary after tax with the Netherlands Salary Calculator including tax adjustments for expats subject to the Dutch 30 rule. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Marriage tax allowance Reduce tax if you wearwore a uniform. I am married and one of us was born before 6th April 1935. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Also known as Gross Income. Why not find your dream salary too. Choose your age range from the options provided and tick the Married Blind or Student Loan box if any of these apply to you.

Gross Net Calculator 2021 of. Hourly rates weekly pay and bonuses are also catered for. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income.

Youll then get a breakdown of your total tax liability and take-home pay. How to use the Take-Home Calculator. It takes into account a number of factors such as tax rates in Malta Social Security SSCNI contributions and government bonuses.

I do not pay NI. Salary sacrifice ni only. All UK tax codes are accepted and will be decoded and automatically checked providing an explanation of the tax code as well as a check to make sure the correct amount of tax is being deducted.

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Your net salary will be calculated automatically. The latest budget information from April 2021 is used to show you exactly what you need to know.

Tax codes valid as of writing include L P T V Y and BR. One of a suite of free online calculators. This income tax calculator or net salary calculator or take home pay calculator is a simple wages calculator displaying a list of already calculated net salary after tax for each possible salary level in the UK.

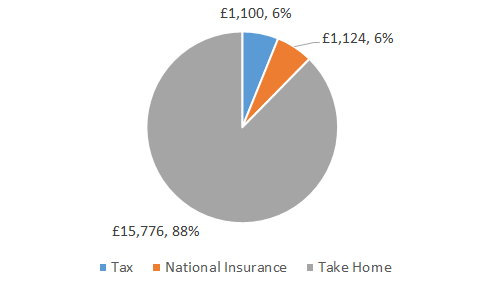

Your average tax rate is 168 and your marginal tax rate is 269. Find out the benefit of that overtime. If you earn 25000 a year then after your taxes and national insurance you will take home 20640 a year or 1720 per month as a net salary.

Salary after tax and national insurance contribution is calculated correctly by assuming that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment. After this you will pay 20 on any of your earnings between 12571 and 50270 and 40 on your income between 50271 and 150000. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. A quick and efficient way to calculate the Netherlands income tax amounts and compare salaries in the Netherlands review income tax deductions for income in the Netherlands and estimate your tax returns for your Salary in Netherlands. Calculate your Married Couples Allowance You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get.

Married Couples Allowance if born before 6th April 1935 8915. This marginal tax rate means that your immediate additional income will be taxed at this rate. To calculate your net income all you need to enter is.

This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no. The Konnekt salary and tax calculator is a new simple tool that gives you a comprehensive overview of your salary while employed in Malta. By admin on 21 June 2019 For the 2019 2020 tax year 28000 after tax is 22576 annually and it makes 1881 net monthly salary.

That means that your net pay will be CHF 41602 per year or CHF 3467 per month. Results will be shown in the right-hand table above. Your taxes will also be calculated.

You need to be married or in a. Net calculator uk salary. The calculations explained These calculations are based on.

Alongside the numeric comparisons the calculator will also breakdown your tax status with the following advanced features. Salary sacrifice tax exempt. This is known as your personal allowance which works out to 12570 for the 20212022 tax year.

Payslip simulator for 50000 salary - Scroll left-right - Employee No. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. Enter the number of hours and the rate at which you will get.

Salary Before Tax your total earnings before any taxes have been deducted. In other words employees wishing to have a specific net salary in a year can use this tool to calculate how high the gross salary. I am eligible for the Blind Persons allowance.

In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a specific net amount. When you have entered your details click on the Calculate button to see how your take-home pay is calculated. Based on a 40 hours work-week your hourly rate will be 1203 with your 25000 salary.

Anything you earn above 150000 is taxed at 45.

Homepay Provided By Breedlove Nanny Tax Nanny Pay Payroll

Paycheck Calculator Take Home Pay Calculator

Charge Out Rate Calculator Plan Projections How To Plan Calculator Rate

14 Charts From Pinterest That Will Make Planning Your Wedding So Much Easier Wedding Planning Timeline Wedding Planning Tips Wedding Timeline

25 000 After Tax 2021 Income Tax Uk

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

Crowdfunding Fur Jedermann Mortgage Process Debt Problem Estate Planning

France Salary Calculator 2021 22

Printable Invoice With Remittance Slip Template Pdf In 2021 Payroll Template Word Template Office Templates

How To Calculate Net Income 12 Steps With Pictures Wikihow

Paycheck Calculator Take Home Pay Calculator

Turbotax Review 2019 For 2018 Tax Year Discounts Turbotax Income Tax Return Tax

Taxable Income Calculator India Income Business Finance Investing

Gross Net Salary The Urssaf Converter

Saving For A Wedding And A House This Year Wedding Engagement Pictures Creative Wedding Gifts Wedding Planning

Cv Template Bahasa Indonesia Resume Format Curriculum Vitae Curriculum Contoh Curriculum Vitae

Post a Comment for "Net Salary Calculator Uk Married"