Salary Sacrifice Yes Or No

Posted 2007-Jun-27 511 pm AEST OP. Salary sacrifice comes at no additional cost to you or your employer and there are several tax benefits for both parties.

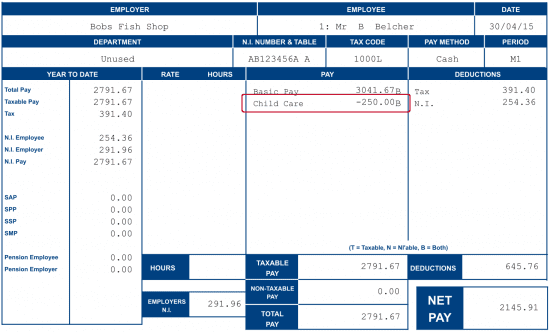

How To Set Up A Salary Sacrifice Deduction E G Childcare Vouchers Iris

Benefits offered can include child care vouchers a company car and additional pension contributions.

Salary sacrifice yes or no. The earnings they exchange for childcare vouchers are gross so there is no. Your employer will be making your car payments directly to the novated leasing provider from your pre-tax income. Last updated posted 2007-Jun-27 556 pm AEST posted 2007-Jun-27 556 pm AEST User 66395 333 posts.

Can I use salary sacrifice if I have bad credit. Input your total annual. Yes you do not have to undergo a credit check to enter into a salary sacrifice scheme as the money is taken from your salary before it even gets to you.

If you buy a notebook that comes standard. If you earn more than 45000 salary salary sacrifice into superannuation is an easy win. The short answer is yes but it will depend on what company and industry you work in.

This means that any income tax calculations will be based on your reduced salary. Quick salary sacrifice q - yes or no. You can use salary sacrifice to increase contributions to your personal pension.

How Salary Sacrifice Works. Posted 2007-Jun-27 511 pm AEST ref. Your employees must sign a salary sacrifice contract to vary the terms of their employment.

Read on for the pros and. This lets them give their employees access to a whole raft of benefits they fund themselves via a payroll deduction. In the simplest terms possible salary sacrifice is an agreement between an employee and employer where the employee agrees to receive less before-tax income.

There are other costs depending on your employer that you can salary sacrifice in order to pay less tax. You give up some of your wages in exchange for extra contributions into your pension or other employer benefits. Your employer will also save money as they wont have to pay Employers National Insurance Contributions.

The answer is always YES. Salary sacrifice lets you make contributions to your pension and helps to save on National Insurance at the same time. Once you accept a salary sacrifice your immediate pay is lower and while this is a short-term sacrifice it can have multiple knock-on effect benefits.

Investment loans cannot be salary sacrificed. In short salary sacrifice pension schemes are can be a good tax-efficient use of your earnings to fund a more comfortable retirement. Typically charity health and not-for-profit industries allow mortgage payments to be salary sacrificed - but only for owner-occupier loans.

These can be things like childcare vouchers or a company car but the most popular type involves additional pension contributions from your employer. You can calculate results based on either a fixed cash value or a certain proportion of your salary. Basically youre using some pre-tax salary and using it to buy something youd typically pay for with.

Sacrifice what you can easily afford up to the cap and take advantage of any employer match schemes associated. In a salary sacrifice car lease your employer is part of your purchasing agreement with your chosen novated leasing company. Salary sacrifice is when you agree to exchange part of your salary so you can get extra benefits from your employer.

Is salary sacrifice super worth it. It is simple to follow and shows how you can benefit from doing this. Salary Sacrifice involves the employee agreeing to formally give up some of their existing taxable salary in return for a non-cash benefit.

Its crucial to note this is taken from their GROSS salary before tax and NI is deducted. But is it worth doing. In return for their sacrifice the employer agrees to provide them with benefits of comparable value.

By arranging for a salary sacrifice car lease you can pay for the vehicle you want as part of your salary package. When you give up part of your wages through a salary sacrifice scheme youll pay less tax and national insurance on your gross earnings. Salary packaging also known as salary sacrifice is an arrangement between you and your employer where you pay for some items or services straight from your pre-tax salary.

Thats because aside from any profit from investment decisions your pension will grow by more than the additional contribution you put in from your salary sacrifice. A salary sacrifice scheme is an arrangement between you and your employer where you give up or sacrifice a portion of your salary in exchange for other non-cash benefits. Salary sacrifice is a way of an employer offering more benefits at no cost to them.

Salary sacrifice and tax. However depending on what you want to use a salary sacrifice scheme for. This has been updated for the current tax year of 202122.

No a salary sacrifice agreement is only valid from the date the contract is drawn up between you and your employer. Archive View Return to standard view.

Everything You Need To Know About Salary Sacrifice Banker On Fire

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Superannuation And Salary Sacrifice Two To Fire

Salary Sacrifice Disadvantages Are Benefits Made Difficult For Hr

Salary Sacrifice Letter Template Request To Make Salary Deductions

Leasing Salary Sacrifice Is It Worth It One Advisory

Salary Sacrifice Nest Pensions

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Everything You Need To Know About Salary Sacrifice Banker On Fire

Salary Sacrifice Employee Purchases Myob Accountright Myob Help Centre

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Salary Sacrifice Nest Pensions

How Do Employers Operate An Employee Salary Sacrifice The Accountancy Partnership

Salary Sacrifice Superannuation Fixed Amount Support Notes Myob Accountright V19 Myob Help Centre

Dr Tony Goldstone On Twitter 1 Thread About Salary Sacrifice Leasing Nhs Pensions Including A Free Little Tool To Do The Sums One Of The Things I Get Asked

Salary Sacrifice Nest Pensions

What Does Coronavirus Mean For Salary Sacrifice The Accountancy Partnership

Everything You Need To Know About Salary Sacrifice Banker On Fire

Post a Comment for "Salary Sacrifice Yes Or No"